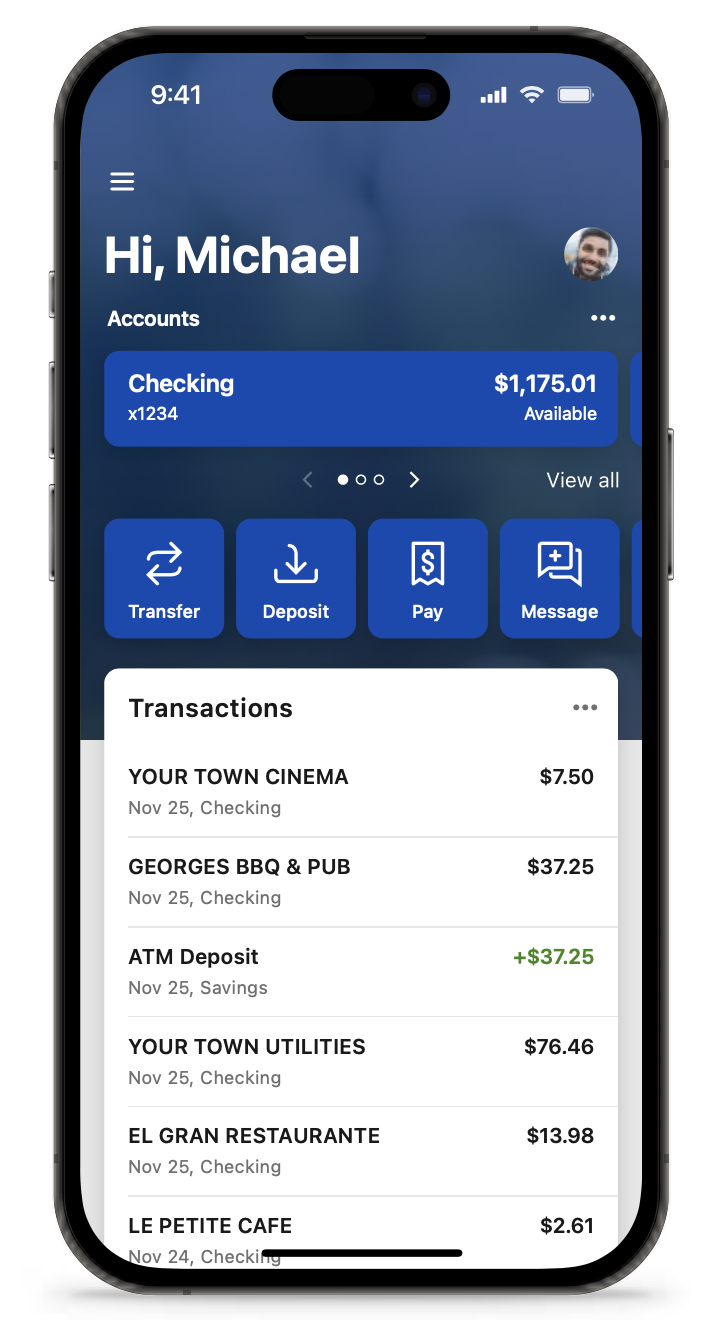

You pretty much live on your cellphone, so why not use it to access your Wayne Westland Federal Credit Union accounts? We offer both a mobile app that gives you 24/7 access. Keep in mind, you need to be enrolled in our online banking to use either.

Mobile App

- Touch ID, PIN authentication or Face ID

- View balances and account activity

- Make deposits with a snap of your camera

- Bill pay and person-to-person payments

- Transfer funds

- Personalize your app

- Branch and ATM locations

- Chat feature

- Apply for an InstaCash Loan

- Manage your WWFCU debit or credit card(s)

- View and monitor your credit report

Mobile Banking FAQs

1. How do I log out of the app/online banking?

Click on the three lines at the top left of the page. Then, at the bottom left of the page, click on your name. This will open a small menu box. Select Sign Out and you will be logged out of your account.

2. Where do my pending transactions show up?

- Online Banking: Select the share you wish to view. On the left, it will show the lists of all your transactions. Any pending transactions will show at the very top. There will be a black box with the word Pending showing underneath the information about the pending transaction.

- Mobile App: Select the share you wish to view, then select Transactions. Any pending transactions will show at the very top under the Pending heading. There will also be a black box with the word Pending showing underneath the information about the pending transaction.

3. What is One Click, and why am I receiving an email from them?

- One Click is WWFCU’s Bill Pay system. You are receiving an email because you are signed up for Bill Pay. There is a general one that gives you instructions on how to set up a payee. There is also an email sent if you have not utilized the Bill Pay system in quite a while. If you would like to unsubscribe from the emails, you can either call Bill Pay support at 800-254-2195 or click unsubscribe at the bottom of the email. You can also reach out to Bill Pay support through their chat (Online Banking only). Click on Manage Payments, and then in the top right corner, click on the Chat Now option. If you no longer wish to have Bill Pay, please call Bill Pay support at the number above, or you can contact us and we can deactivate the account

4. Why does it keep asking for two-factor authentication verification on my online banking?

- Each time you log into online banking, it will ask you for a verification code. To turn this off on the browser you are on, you can click on the box that says, “Don’t ask for codes again while using this browser”.

5. What is the difference between my password and my passcode?

- The password is the specific password you set up for your account. This password must be between 8-20 characters long. The password can be used in the Mobile App and must be used in Online Banking.

- The passcode is a 4-digit code you set up on your mobile app to log into your account. The passcode is specific to the Mobile App

6. Where can I find my routing number & account number on the app/online banking?

- Online Banking: From your dashboard, click on the Savings or Checking account. On the right, under details, the routing and account number will be displayed.

- Mobile App: From your dashboard, click on the Savings or Checking account. Scroll down to Details to view the routing and account number.

7. Can I view a check image?

- Online Banking: Click on the Checking account box. You can either scroll down the list of transactions and find the check or you can choose to click on the magnifying glass and search for the check number specifically. Click on the check transaction. This will open a new box. Under Images, click on the box of the image you’d like to view.

- Mobile App: Click on the Checking account box. Select Transactions, then you can either scroll through the transactions to search for the check, or you can click on the magnifying glass and put in the check number you are searching for. Click on the check transaction, then click on the image box to view the check.

8. Where are my statements?

- Online banking: On the Dashboard page, click on the Documents box. This will open the Statements page where you can view your Account Statements, Visa Statements, and Tax Documents. You can also select Documents under each of your Share boxes as well.

- Mobile App: On the Dashboard page, click on the Documents box. This will open the Statements page where you can view your Account Statements, Visa Statements, and Tax Documents. You can also select Documents under each of your Share boxes as well.

9. My device is updated, and I cannot download the Mobile App. Why?

- To support the security measures we’ve put in place to keep your data safe, we require the use of a modern browser. As new versions of browsers are released, the Banno Digital Platform will deprecate support for older versions. Below are the details for each supported browserMobile Operating Systems

- iOS: Effective on November 18, 2024, the app is supported on Banno Mobile version 3.7 or newer on devices running iOS version 17.0 or newer.

- Android: Effective March 19,2024, our Android app is supported on Banno Mobile version 3.7 or newer on devices running Android version 8.0 and newer.

Browsers

- Microsoft Edge: Microsoft Edge will be supported at the latest version only. The Banno Digital Platform may deny access to older Microsoft Edge versions 60 days after a new version is released. The legacy version of Microsoft Edge now has an official end-of-life date from Microsoft.

- Google Chrome: Chrome should automatically update, and major updates are released approximately every 12 weeks. If Chrome is two versions older than the current stable channel version, the Banno Digital Platform may deny it access.

- Apple Safari: Each year Apple typically makes upgrades to Safari during the fall. Approximately 60 days after a new version is released, the Banno Digital Platform may deny older versions access. However, this change requires that the new Safari version is available on both MacOS and iOS devices.

- Mozilla Firefox: FireFox should automatically update. If FireFox is two versions older than the current stable channel version, the Banno Digital Platform may deny it access.

10. How do I transfer my account at another financial institution?

- Online Banking: Click Transfers on the left side of your screen. On the next page, select “+ External Account.” The system will ask you to confirm your password to continue. Once you do this, it will take you to the screen where you will enter the account information for the account you want to transfer the funds to. Click submit when you are finished. This account will show available when you click on Transfers; however, there is another step before you can process an external transfer. There will be two micro deposits that will be sent to the other account for you to verify. They take approximately 3-6 business days. Once you receive them, click on the account that you set up in your online banking, and enter the micro deposits. Once they are verified, the account will be available to transfer to and from.

- Mobile App: Click on the three lines in the top left of your screen. Select Transfers. Under “Make a Transfer,” select the arrow next to the option “Transfer to other institutions by adding an external transfer account.” Click on “Add External Account.” The system will ask you to confirm your password to continue. Once you do this, it will take you to the screen where you will enter the account information for the account you want to transfer the funds to. Click submit when you are finished. This account will show available when you click on Transfers; however, there is another step before you can process an external transfer. There will be two micro deposits that will be sent to the other account for you to verify. They take approximately 3-6 business days. Once you receive them, click on the account that you set up in your app, and enter the micro deposits. Once they are verified, the account will be available to transfer to and from.

11. I logged out of my account, but it logs me back in. Why? (Apple users only)

- When you are first setting up your account through the app, there is an option for you to use the Face ID. If you select to use this option, it will attempt to log you back into your account after you have logged out. To turn this option off for logging into the app, click on the 3 lines in the top left corner of your page, then click on your name at the bottom. This will open the smaller menu box where you will select Settings and then Security. Here, you can toggle off the Face ID option.

12. How do I receive the two-factor authentication if I don't have a cellphone or are hearing impaired?

- Authenticator: This option works for both online and mobile and works best with Google Chrome. Go to the Chrome Web store and search for Authenticator. Click on Get. If you are using a different browser (Microsoft Edge, Firefox, etc.), click on the Add Extension icon, then click on Get Extension. Once the application downloads, you should be able to open it and go through the first-time login process.